Asia’s Booming IPO Pipeline Faces Headwinds as AI Bubble Fears Grow

GeokHub

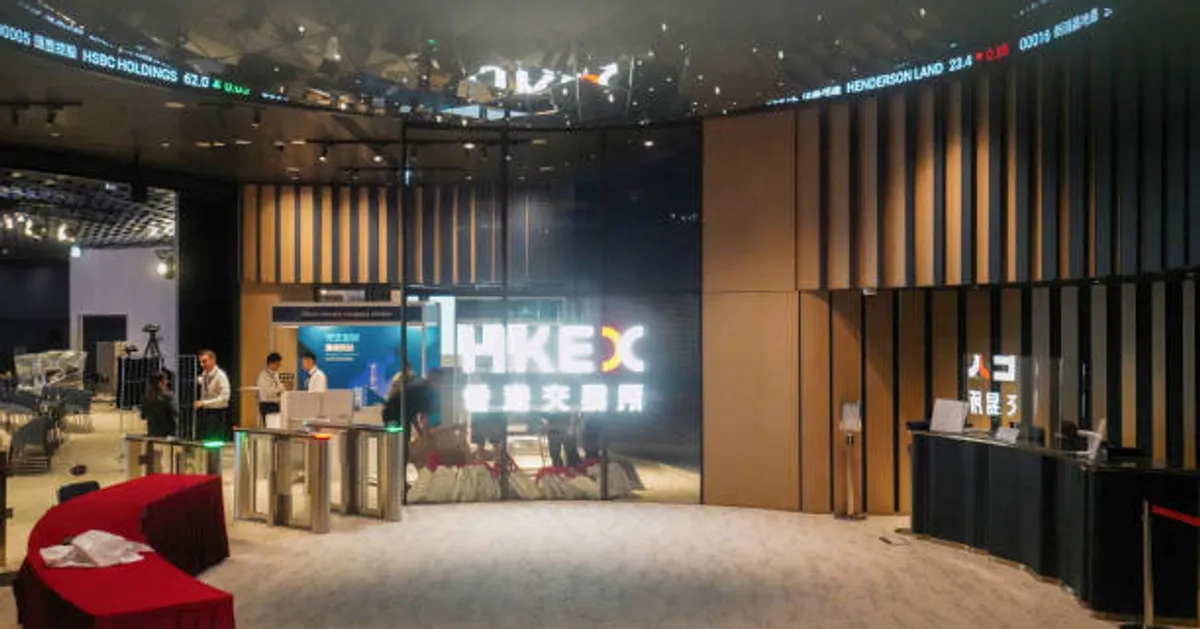

HONG KONG / MUMBAI — Dec 5, 2025 Asia is entering 2026 with a strong backlog of planned equity deals — including IPOs, follow-on share offerings, and convertible bond issuances — largely driven by companies from China and India. In 2025, the region’s equity-capital markets recorded about $267 billion in deals, marking the first annual increase since 2021.

Leading the charge is Hong Kong, with roughly $75 billion in deals this year, while India raised about $19.3 billion through IPOs. Analysts expect upcoming blockbuster listings — such as major technology and infrastructure firms — to further fuel market activity in the year ahead.

But optimism is being tempered by growing concern that surging valuations in AI-related and tech sectors may have overshot fundamentals. Recent volatility in global tech stocks has sparked fears of an “AI bubble,” potentially reducing investor appetite for high-growth, high-valuation IPOs. Companies in sectors heavily tied to AI — including software, chipmakers and emerging-tech firms — may see weaker demand or need to revise valuation expectations if sentiment sours.

trending:

US and Canada Warn of Chinese-Linked Hackers Using Back-Door Malware for Potential Sabotage

Some market watchers argue the uncertainty may benefit more traditional or stable companies whose value is rooted in earnings and cash flow rather than speculative growth. For now, Asia’s equity-deal pipeline remains intact — but its success may depend on whether investors stick to long-term conviction or retreat amid risk aversion.