Europe’s Aerospace Giants Unite to Counter Musk’s Space Dominance

GeokHub

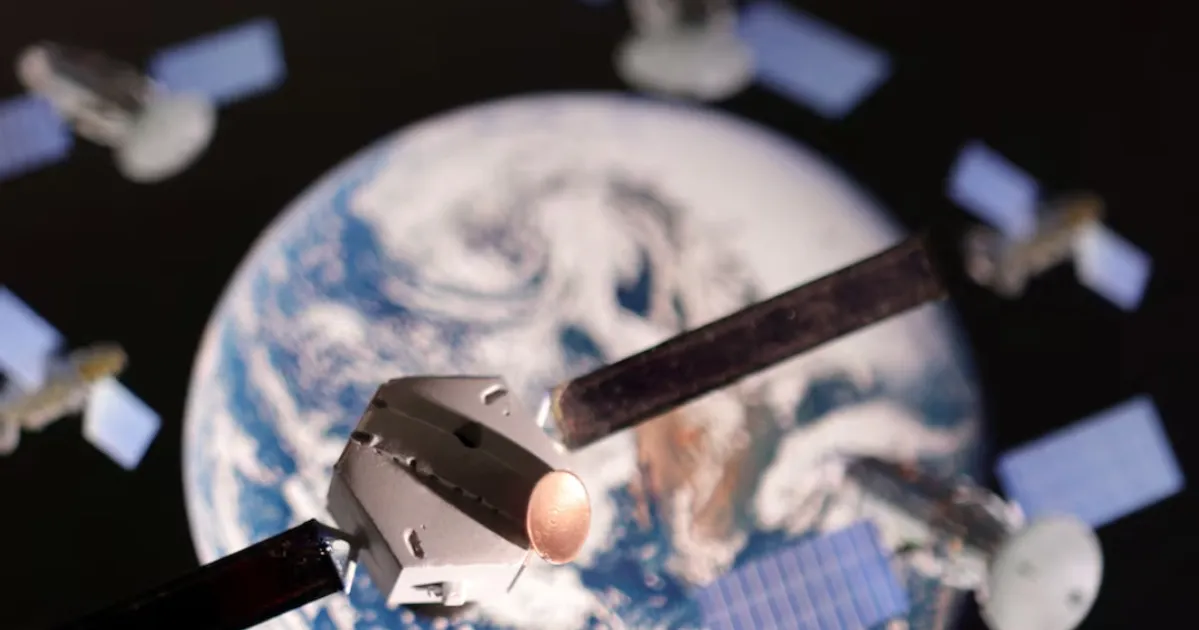

In a bold move to reclaim technological and strategic autonomy, three of Europe’s leading aerospace firms—Airbus, Thales and Leonardo—have announced plans to merge their satellite manufacturing and space‐services operations into a single entity. The initiative, set to launch in 2027 pending regulatory clearance, is directly aimed at countering the rapid expansion of SpaceX and its global Starlink satellite network.

The proposed venture is expected to employ approximately 25,000 people and generate annual revenues of around €6.5 billion, based on 2024 figures. Under the preliminary terms, ownership will be split with Airbus holding 35 percent, while Thales and Leonardo each hold 32.5 percent.

Executives from the three firms say this consolidation is necessary to achieve the scale required to compete with vertically integrated U.S. players building out massive low‐Earth orbit (LEO) constellations. Additionally, the venture is designed to bolster Europe’s space sovereignty—offering satellite services, launch capability, and infrastructure under a unified banner.

Over recent years, Europe’s satellite manufacturers have faced mounting pressures. The rise of cost-efficient, high‐volume satellite constellations like Starlink has disrupted traditional business models that focused on individual geostationary satellites. By aligning resources, the three companies aim to broaden their offerings, cut duplication, and ramp up innovation capacity.

A spokesperson for the alliance commented that the new entity will operate “under joint control with a balanced governance structure” and promised that immediate job cuts are not planned, though appropriate consultations with labour unions will be held.

While the ambition is clear, the path forward remains complex. Merger talks will face scrutiny from European competition regulators, who historically have resisted large consolidations in the aerospace sector. Past negotiations have stalled over governance and national sensitivities, underscoring the challenge of combining institutions rooted in different countries.

Furthermore, Europe’s competitiveness in rocket launch and satellite internet services still lags behind entrenched U.S. players that benefit from scale, reusable launchers, and integrated ecosystems. Some analysts caution that the merger must deliver speed and efficiency gains to avoid falling further behind.

The move comes as governments across Europe increasingly regard space as a critical strategic domain—vital for security, connectivity, surveillance and climate monitoring. A stronger unified space company could better support national programmes, carry out defence contracts and work with public agencies on sovereign communications infrastructure.

For Airbus, Leonardo and Thales, the venture represents both an opportunity and a gamble: can they turn a fragmented European space sector into a single, competitive heavyweight? If they succeed, Europe may break into the big league of global space players. If not, Europe could remain reliant on external providers at a time when space capability increasingly drives geostrategic advantage.