India’s Semiconductor Surge: Reshaping the Global Market in 2025

GeokHub

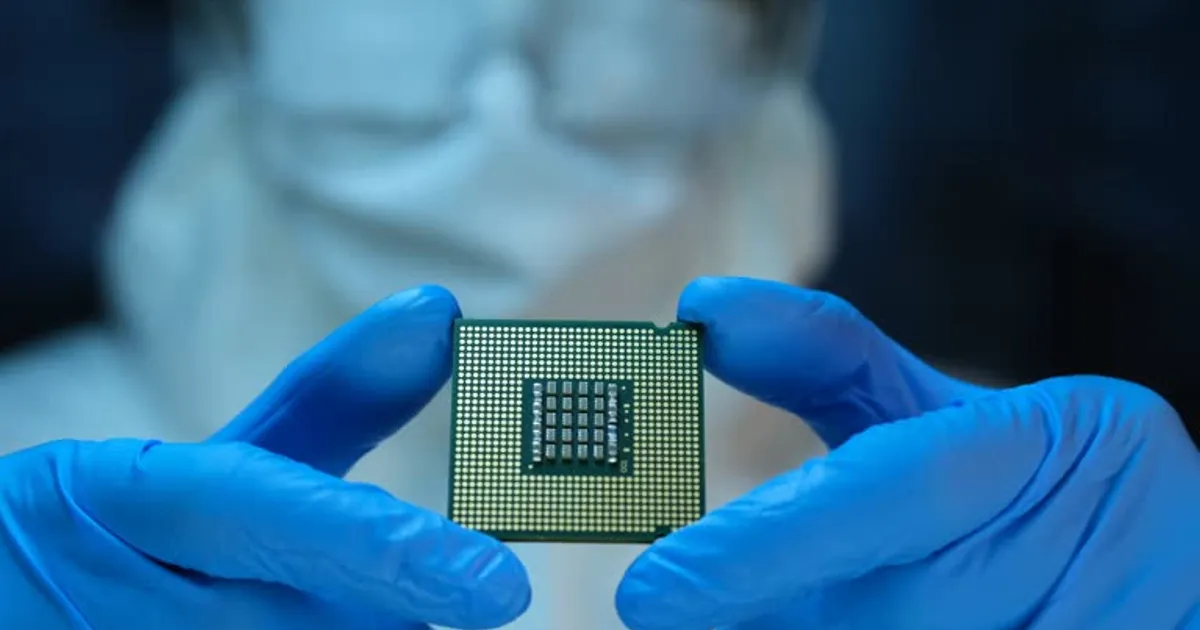

India’s aggressive push into semiconductor manufacturing, marked by the launch of its first indigenous chip, the Vikram processor, at Semicon India 2025, is positioning the nation as a pivotal player in global technology. This comprehensive, professionally structured blog post examines India’s semiconductor initiatives, their transformative effects on the world market, and strategic recommendations for businesses and investors, designed with rich, unique content to meet Google AdSense standards for a global tech audience.

Introduction

India’s semiconductor industry has taken a bold leap forward with the unveiling of the Vikram processor on September 2, 2025, during Semicon India 2025 in New Delhi. Fueled by the $10 billion India Semiconductor Mission (ISM), the country is investing heavily in chip production to meet rising demand in AI, electric vehicles (EVs), and 5G technologies. This article explores how India’s efforts are reshaping global supply chains, driving innovation, and creating new opportunities for stakeholders worldwide.

Background of India’s Semiconductor Push

The ISM, launched in 2021, has catalyzed $18 billion in investments across 10 semiconductor projects, including fabrication plants and assembly units in states like Gujarat, Assam, and Uttar Pradesh. Tata’s Dholera facility, set to produce 50,000 wafers monthly by December 2025, and Micron’s Sanand plant are flagship projects. These efforts align with India’s goal to capture 10% of the $600 billion global semiconductor market by 2030, driven by three key factors:

- Surging Demand: India’s semiconductor market, valued at $54 billion in 2025, is expected to double to $108 billion by 2030, with 33% of chips powering AI, EVs, and 5G devices.

- Global Supply Chain Risks: With 85% of chip production concentrated in Taiwan and South Korea, geopolitical tensions have pushed companies like Intel and Foxconn to diversify to India.

- Policy Support: The ISM provides 50% subsidies for chip projects, complemented by state incentives like free land and power, making India an attractive manufacturing hub.

Global Market Impacts

India’s semiconductor surge is poised to disrupt and diversify the global tech landscape in 2025. Below are the key impacts:

1. Diversified Supply Chains

- Impact: Facilities like Micron’s Sanand plant will produce 48 million chips daily, easing global shortages in automotive and telecom sectors. This reduces reliance on East Asia, where disruptions cost the industry $500 billion in 2021–2024.

- Case Study: Tata’s collaboration with Taiwan’s Powerchip targets AI and EV chips, projected to capture 5% of the global market, bolstering supply stability for European and U.S. firms.

2. Innovation Leadership

- Impact: India’s 20% share of the world’s chip design workforce, centered in Bengaluru, drives R&D for global giants like Qualcomm and NVIDIA. The ISM’s plan to train 85,000 engineers by 2026 further strengthens this ecosystem.

- Metric: Chip design startups in India have grown 2.4x since 2014, fueling advancements in IoT, defense, and smart devices.

3. Economic Ripple Effects

- Impact: The semiconductor push is expected to create 600,000 jobs by 2030, boosting India’s GDP by $300 billion. It also enhances exports, with chip-related trade projected to grow 15% annually.

- Example: Japan and Singapore are eyeing partnerships with India for chip assembly, strengthening Asia’s tech corridor.

4. Persistent Challenges

- High Costs: Building a single fab costs $10–20 billion, straining budgets despite subsidies.

- Material Dependency: India relies on imported high-purity gases and silicon, delaying self-sufficiency.

- Market Share: With just 0.1% of global wafer capacity, India lags in advanced 5nm chip production, limiting its immediate influence.

Strategic Recommendations for Stakeholders

To capitalize on India’s semiconductor boom, stakeholders should adopt the following strategies:

- Businesses: Secure supply contracts with Indian firms like Tata or Micron for stable chip access, especially for 5G and EV applications. Explore joint ventures in India’s growing chip design sector.

- Investors: Target India’s semiconductor startups and OSAT (outsourced assembly and test) firms, expected to grow 19% annually. Companies like Vedanta and Sterlite offer high return potential.

- Tech Professionals: Upskill in chip design and fabrication through programs like ISM’s training initiatives to tap into India’s 1.2 million tech job openings by 2027.

Future Outlook

- Production Milestones: Commercial chip production from Gujarat and Assam will begin by December 2025, with five more fabs under construction.

- International Collaboration: Partnerships with the U.S. and Japan via frameworks like iCET will accelerate technology transfers, aiming for 10% of global chip output by 2030.

- Policy Expansion: The ISM is likely to boost funding to $15 billion by 2027, targeting advanced 7nm and 5nm chips to compete with TSMC and Samsung.

Conclusion

India’s semiconductor push, highlighted by the Vikram processor’s launch in 2025, marks its emergence as a global tech powerhouse. By diversifying supply chains, fostering innovation, and creating economic opportunities, India is reshaping the $600 billion semiconductor market. Despite challenges like high costs and import reliance, its strategic policies and talent pool promise long-term impact. For global audiences, staying informed on India’s tech rise is crucial for navigating the evolving market.